us exit tax form

Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. Legal Permanent Residents is complex.

James Baker Has Hired You To Prepare His 2018 U S Chegg Com

Green Card Exit Tax 8 Years Tax Implications at Surrender.

. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or. Citizen and certain legal permanent residents who are long-term residents The form is filed when the Taxpayer files. The IRS Form 8854 is required for US.

Yes even if you are not a covered expatriate under the Exit Tax tests and dont owe any Exit Tax you must file Form 8854. Exit taxes can be imposed on individuals who relocate. Not every US expatriate is a covered expatriate there are three tests.

Exit tax is a tax paid by US covered expatriates who want to renounce their US citizenship or Green Card. About Form 1040-NR US. At the time of writing the current maximum.

Individuals who renounce United States citizenship and certain permanent residents who cease being such may be subject to an alternative tax regime known colloquially as the exit tax or. Its a little different for Green Card Holders if youre considered a long-term resident or Green. The second way you can be required to pay exit taxes is if you have not complied with your US tax obligations in the last five years.

Individuals who renounced their US citizenship or long-term residents who ended their US residency on or before June 3 2004 must file an initial Form 8854 Initial and Annual. The Form 8854 is required for US citizens as part of the filings to end. Green Card Exit Tax 8 Years.

The IRS Green Card Exit Tax 8 Years rules involving US. Attach your initial Form 8854 to your income tax return Form 1040 1040-SR or 1040-NR for the year that includes your expatriation date and file your return by the due date of. The idea of the exit tax is the concept that if a US person falls into one of the two categories of being a Long-Term Resident or US Citizen and 1 they have assets that have accrued in value.

You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Nonresident Alien Income Tax Return About Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701b Page Last Reviewed or.

How To File A J 1 Visa Tax Return And Claim Your Tax Back 2022

What Is Form 8854 The Initial And Annual Expatriation Statement

Form 8854 For American Expats Expat Tax Online

Part 5 Understanding Exit Taxes Taxconnections

How To Renounce A Us Green Card Gracefully Expat

Renounce U S Here S How Irs Computes Exit Tax

What Is Form 8854 The Initial And Annual Expatriation Statement

Us Resident For Tax Purposes Faq Page 1040 Abroad

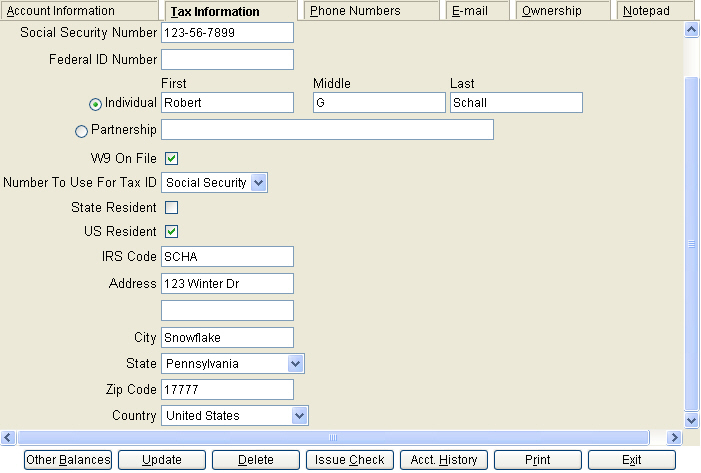

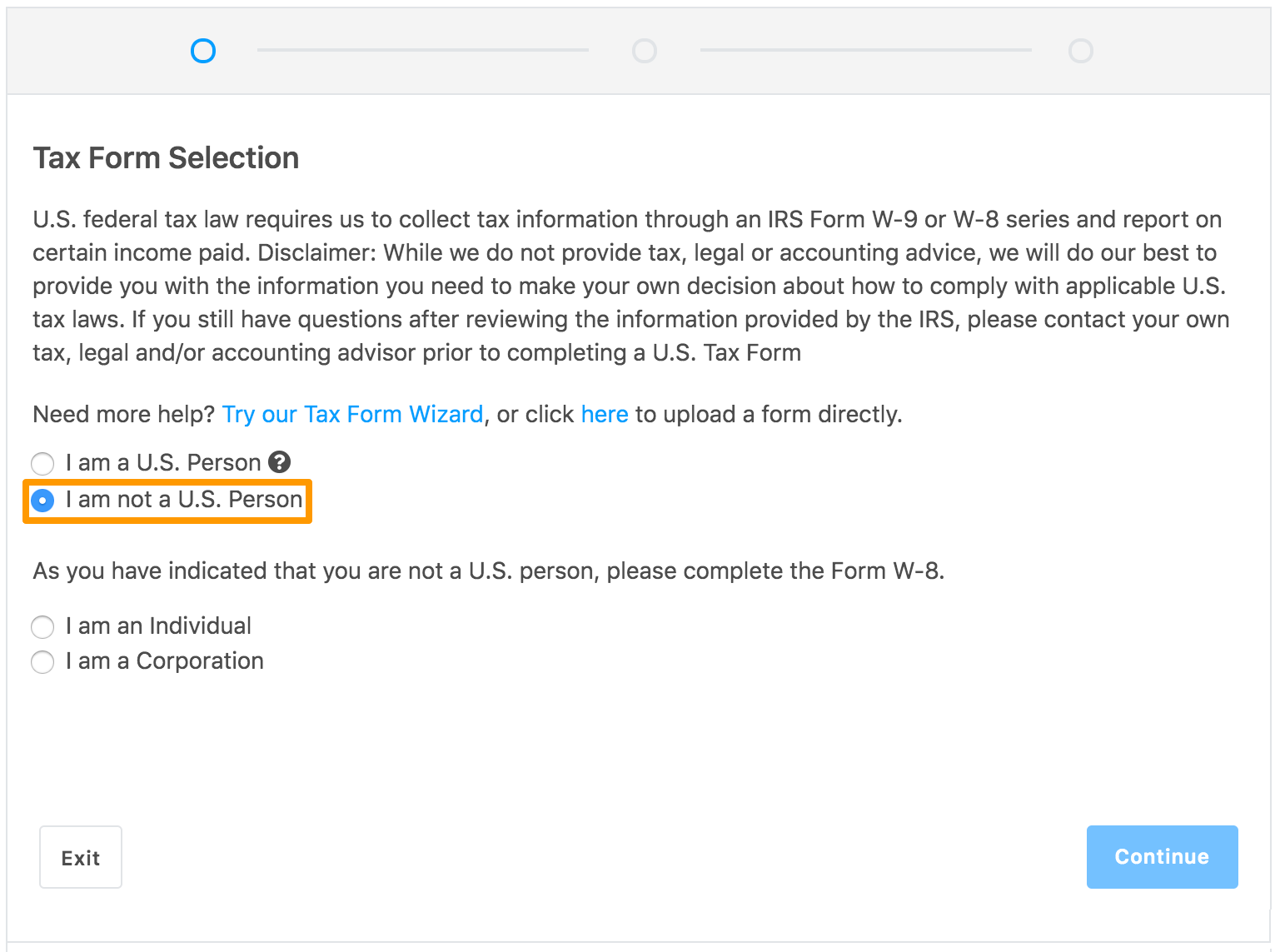

Submitting Tax Form For Non Us Person Individual Bugcrowd Docs

Wash Sale Rule What To Avoid When Selling Your Investments For A Tax Loss Bankrate

Filing Your Non Resident Tax Forms Using Sprintax F And J Isso

Irs Audit Techniques Expatriation Tax Expatriation

Expatriation Tax Form 8854 Is Part Of Criminal Tax Case Tax Expatriation

The New Form 8854 Reporting Requirements Explained 2022

How To Order Tax Return Transcripts Financial Aid

What Is Form 8854 The Initial And Annual Expatriation Statement